Search and optimising the future – Banker Middle East May 2014 Issue

Netizency’s Co–Founder and Chief Strategy Officer Fadi Khater discusses the benefit of search data for Banking and Finance Institustions (BFIs) digital social marketing and brand building, with Zoya Malik.

Do tell us about the work you have conducted on searches for the BFI industry, why is the data important and how do they use it?

“Search data is extremely important for clients because it estimates demand. We know that there are 55,620 searches in MENA relating to credit cards every month; for example the most searches for credit cards in Oman take place on the first week of July. This information indicating consumer behaviour can help us determine the market size, the cost required to reach our objectives and the best time to advertise or launch a new product. Search is the most basic yet extremely important form of digital marketing; because a search engine is typically where any user starts his/her browsing experience. We see Google as a salesman who people go to for advice. The most typical scenario would be John wants to open a bank account, he goes to Google; types ‘Banks in Dubai’ and would get results (recommendations from Google). Banks need to make sure that they appear and rank as high as possible in that recommendation list. Almost one million searches about banking and finance take place every month in MENA*. Netizency’s Co–Founder and Chief Strategy Officer Fadi Khater discusses the benefit of search data for Banking and Finance Institustions (BFIs) digital social marketing and brand building, with Zoya Malik “We help banks and financial institutions appear on Google in two ways; SEM & SEO. SEM (Search Engine Marketing) involves buying ads on Google – the ad will appear as a sponsored search result with a small yellow square indicating that it’s an ad. The placement of the ad in terms of rank is a function of Bid x Quality Score; where quality score indicates how good the site is and how relevant it is to the keyword being searched. All ads on Google are done in the form of an auction; the advertiser sets a maximum bid and once a search takes place a live auction takes place to determine the ads that will appear and their rank. HSBC is the top ranking search ad for the keywords ‘Bank in Dubai’. “SEO (Search Engine Optimisation) is how a website is optimised so that search engines pick it up organically (without advertising); There are many ways for optimising websites the most important of which include using the most searched keywords in the content and meta tags, in addition to creating as many inbound and outbound links to the site as possible. United Arab Bank is the bank that appears first in the organic search results.”

What do BFIs need to do to reach their customers using social media?

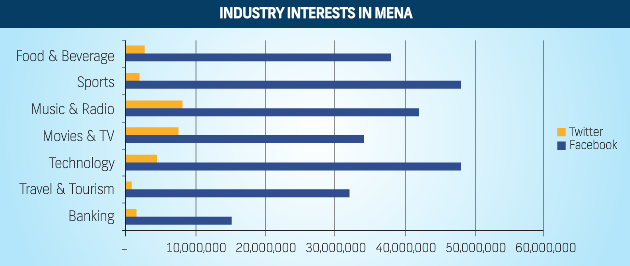

“Social networks are where people go to socialise; they are not a place where people seek exposure to hard sell campaigns or annoying sales calls. For BFIs to successfully integrate on social channels they need to be human, relevant, and engaging. Relevant content should be tailored to the specific locations and target content based on interests. The content needs to be human whereby customers feel that they are interacting with real people as opposed to automated messages; this can be done by staff videos explaining products, live Q&As, or testimonials from clients. The last and most important point is the engagement aspect; people want to feel important, so brands must ask for their opinion and involvement. “Social Media marketing allows content to appear in your newsfeed as opposed to you actively searching for it. Being in its target audience’s newsfeed should be the most important objective for a bank. Each newsfeed is different; every person’s newsfeed is a curation of the things that he/she likes including friends, family, brands, and news. “Social content can appear in one’s newsfeed organically or in a paid manner. The most engaging posts have a higher likelihood to appear organically, whereas less engaging ones need to be promoted. Facebook shows brand posts to less than six per cent from the people who like a brand page – this percentage varies according to number of page likes, type of post (text, link, image, video), and number of engagements. A post can appear in your newsfeed because a brand posted it or because a friend interacted with it. Twitter on the other hand shows all posts to all followers however, because we tend to follow many people but we only read the last 30 tweets when we open Twitter; brands need to promote their posts for them to stay at the top of a user’s newsfeed. “Brands can target people on social channels based on their interests. Interests are determined based on who people follow, their activities, or interests that they indicated. There are 15.2 million people on Facebook and 1.4 million people on Twitter in MENA who are interested in banking and finance.”

How well does the BFI industry fare in terms of audience reach, vis a vis other sectors?

There are fewer people interested in banking than other sectors; this is because people are less passionate about banks than they are towards travel, sports or technology. For industry interests in MENA see graph:

Can you share some BFI client objectives and case studies?

“Engagement on social media is like any other form of engagement; the end objective is almost always to increase revenues, but that is done through creating awareness, offering a better service, and giving back to the community. Here are some examples: “CSR: When Qatar National Bank wanted to develop a strategy for Corporate Social Responsibility; they decided to go social. The bank asked the residents of Qatar how they wanted their bank to help. This question led the public to recommend a multitude of activities and recommendations that inspired the bank’s CSR strategy. “Ad Feedback: QNB occasionally used Facebook to get people’s feedback on their advertising; the most prominent of which was when they got the biggest hoarding on the Doha Corniche – the feedback helped confirm the communications team’s idea and aided them in selling the advertising concept to the bank’s senior management. “Announcing financial results and economic reports: Social channels are the best platform to announce financial results and share economic outlooks since they arrive in the relevant people’s newsfeeds and they get shared by friends; ensuring that the relevant people find out about them. “Team Engagement: People want to feel that their banks are human and social channels help in making that happen. Banks can get their staff to talk to the public through videos explaining products or live Q&A sessions.” How advanced are BFI companies in social media marketing in the Middle East? “BFIs in MENA are relatively weak when it comes to activating marketing promotions contrary to telecom operators. Most of the banks use social networks as push marketing channels like TV and press as opposed to using them for engagement, personalisation or co-creation.”

Which companies in the Middle East use social media well? Why is this so?

“Let me start with an overview on social media followers across different industries: “Media including the likes of MBC and AlJazeera tend to be the channels with the largest numbers of fans since people actively seek their content as opposed to other brands that use social media for self-promotion purposes. Telcos follow since their customers use social channels for customer service and wanting to stay up to date with the latest offers and win contests. “Airlines come next as they have a very large pool of global audience to get followers from